If you want to retire a millionaire, there are many ways to do so, without having to take on significant risk. Even if you don’t have a boatload of money to invest in the stock market today, simply adding to your position over time with regular monthly investments can lead to significant returns in the long run.

Investing in top exchange-traded fund (ETF) can be a low-risk strategy to deploy that can put you on a path to growing your portfolio to $1 million — and potentially higher — by the time you retire. Here’s how investing $250 a month can set you up for a much more enjoyable retirement.

Image source: Getty Images.

Invest in a top Vanguard fund that’s focused on growth

Vanguard ETFs typically come with low fees, have excellent diversification, and can make for solid long-term investments. The Vanguard Russell 1000 Growth Index Fund ETF (VONG 0.03%) is an excellent example of an ETF that you can safely put money into on a regular basis.

It has a modest expense ratio of just 0.07% and holds nearly 400 stocks. It focuses on growth and tracks the Russell 1000 Growth Index.

Tech is a major part of this ETF, accounting for over 56% of its total holdings. The next-largest sector, consumer discretionary, makes up just 19%.

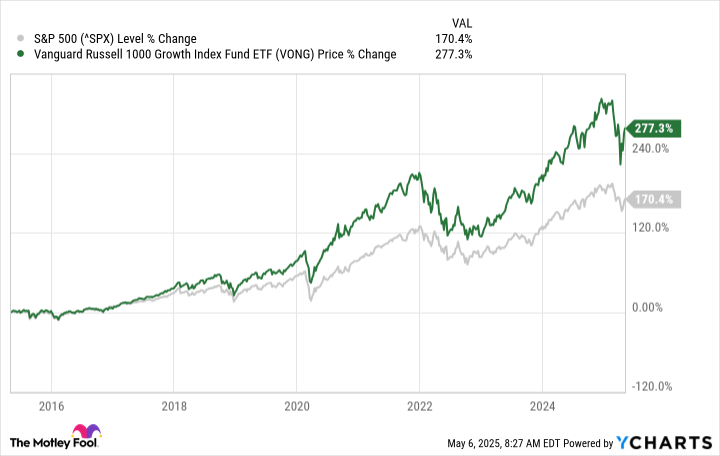

As a result, there will be some volatility from one year to the next, but overall, the long-term trajectory should be a strong one. Over the past decade, the fund has outperformed the S&P 500 by a wide margin.

^SPX data by YCharts.

Past results don’t predict the future, but the ETF’s focus on growth stocks should make it an ideal fund to invest in over the long term, since it may be in a good position to outperform the broader markets.

How a monthly $250 investment could grow to over $1 million

If you’re patient and continually invest $250 per month into the ETF, you could end up with a portfolio worth over $1 million. There are no secrets involved, it’s just a matter of simply compounding your gains over the long haul.

Here’s how your portfolio’s value could grow, assuming you average an annual return of 10%, which is in line with the S&P 500’s long-run average.

| Portfolio Balance Assuming a $250 Monthly Investment | |

|---|---|

| Year | 10% Annual Growth |

| 30 | $569,831 |

| 31 | $632,668 |

| 32 | $702,084 |

| 33 | $778,769 |

| 34 | $863,484 |

| 35 | $957,069 |

| 36 | $1,060,454 |

| 37 | $1,174,665 |

| 38 | $1,300,836 |

| 39 | $1,440,218 |

| 40 | $1,594,195 |

Calculations and table by author.

Under these assumptions, it would take approximately 36 years for this investment strategy to result in your portfolio’s balance rising to more than $1 million. This means continually investment every month for 36 years. But there are a couple things to consider with this.

The first is that your average annual return plays a big role in determining these values. If the ETF performs better than 10%, then you can reach the $1 million mark sooner. On the flip side, however, slow market conditions could mean it takes more than 36 years.

Second, you can accelerate these gains by investing more money over this timeframe. Whether it’s an inheritance, money from tax returns, or a profit from the sale of a house or investment, any extra money you can afford to invest in the fund will result in more compounding over the years, which will strengthen your portfolio’s overall returns.

It may not be exciting, but this is a safe way to invest for the long haul

You might be tempted to pursue more-aggressive growth investments that promise quicker and higher returns, but those will come with much more risk. By going with this route, you can ensure your money is safe and your returns don’t hinge on a few risky investments. While you may see your portfolio’s balance fall in a year if the overall market performs poorly, over the long term, you can expect to see it rise significantly.

Staying invested and adding to your position in a top fund like the Vanguard Russell 1000 Growth Index Fund ETF can give you the best of both worlds — long-term safety and great returns.

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.