Tesla (NASDAQ: TSLA) has long been a divisive stock among investors. This year, the tug-of-war between Tesla bulls and bears has put the stock in the red for the year, down about 10%.

Let’s look at three issues to evaluate when looking at the stock and whether it is ultimately a buy, sell, or hold.

EV sales are slowing

While Tesla has a number of far-reaching ambitions, its main business at this time continues to be making electric vehicles (EVs). On that front, the company is seeing industry growth slow, and more competition enter the space.

The industry as a whole set a record in the U.S. in the second quarter, but EV sales growth still slowed to 11%. That’s compared to about 52% growth for the full year 2023.

Tesla, meanwhile, saw its deliveries drop by 5% in the second quarter to 443,956, while automotive revenue fell by 7% to $19.88 billion. Vehicle product in the quarter sank 14% to 410,831 vehicles, its lowest level since the third quarter of 2022.

EV sales are slowing as consumers worry about the current very high costs of battery replacements, which can cost up to $20,000, and the subsequent high depreciation EVs are seeing as they age due to this cost. Not all consumers have easy access to home charging, while others are still leery of running out of power on longer trips.

These concerns have led to more interest in hybrid vehicles. Hybrids have smaller batteries and thus a smaller replacement cost, and have regenerative brake charging, so many don’t need to be plugged in and still can take gasoline. As EV sales have slowed in the U.S., hybrid sales have climbed 41%, and plug-in hybrid (PHEV) sales have jumped 49%. The same dynamics can be seen in China, where EV sales rose 13% in Q2 and PHEV sales soared 98%.

Tesla, for its part, has recognized the impact that hybrid sales are having on its business but has said it’s the wrong strategy and that EVs will eventually win out. Right now, this could turn out to be a shortsighted view.

Image source: Getty Images.

Robotaxi business

One of the biggest bullish arguments for buying Tesla is the robotaxi business it is developing. In fact, longtime bull Cathie Wood of Ark Invest has based most of her thesis for owning the stock on the potential of this business, which she sees eventually becoming 86% of Tesla’s earnings before interest, taxes, depreciation, and amortization (EBITDA) in 2029. This would mean any slowdown in its EV business wouldn’t be that impactful to the company over the long run.

Wood believes that after operating its own robotaxi fleet for a few years, it will eventually pass them on to rideshare companies while getting an 80% take rate of rides, while the rideshare companies earn $0.20 per mile.

While that is an intriguing thesis, the fact of the matter is that this business model is not yet proven. How major cities regulate the business and how consumers respond to the service are both unknown.

At the same time, Tesla is not the only game in town. Waymo, backed by Alphabet, recently announced that it is seeing more than 100,000 paid trips per week, which happens to be 100,000 more a week than Tesla. Waymo is currently operating in the cities of Phoenix, Austin, Los Angeles, and San Francisco, as Arizona, Texas, and California are currently the only states that currently allow robotaxis. For its part, Tesla has yet to apply for permits in these states, according to a recent Rolling Stones article. There are other players in the robotaxi space as well, including Cruise and Zoox.

If there are multiple players in the robotaxi space, the economics are highly unlikely to be as good as Wood projects. Meanwhile, a number of critics in the Rolling Stones article question if Tesla can even deliver on the technology it has been promising regarding robotaxis.

Valuation is tricky

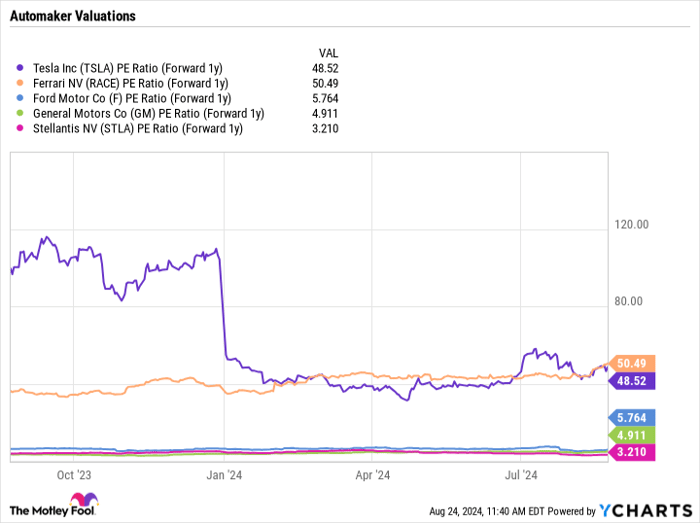

As a traditional automobile company, Tesla would be considered very overvalued, trading at a forward price-to-earnings (P/E) ratio of 48.5 based on next year’s estimates, while traditional automakers are trading under 6 times. Ferrari, which trades at 50 times, is more in line with Tesla, but the company should be viewed more as a luxury company, as its vehicles cost as much as a house in many parts of the U.S. Ferrari has also been performing much better than Tesla, with 16% revenue growth and 25% adjusted EPS growth in Q2.

TSLA PE Ratio (Forward 1y) data by YCharts

Tesla is more than an automobile company; much of its valuation is based on Musk’s future vision rather than its current operations. And that is where things get tricky.

Buy, sell, or hold?

Investors who believe in Musk and his robotaxi vision, as well as his other proposals, such as using its fleet to help power AI or its robot Optimus, should continue to hold the stock. However, if there is doubt creeping in that these moves will pan out, given the shift from EVs to hybrids that the market is seeing, now is probably the time to sell.

For me, I prefer to stay on the sidelines.

Should you invest $1,000 in Tesla right now?

Before you buy stock in Tesla, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Tesla wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $774,894!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 26, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet and Tesla. The Motley Fool recommends General Motors and Stellantis and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.