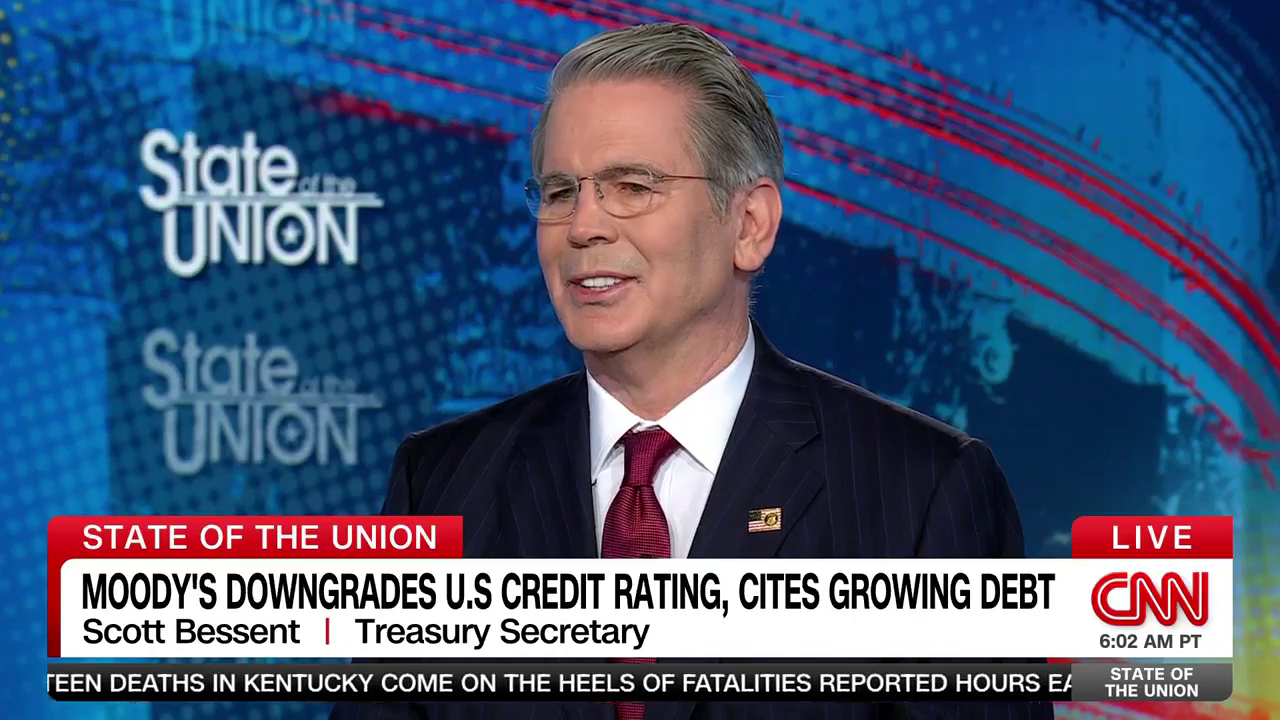

US Treasury Sec. Scott Bessent blew off Moody’s recent downgrade of the US credit rating and instead promoted the fairy tale that their tax cuts will pay for themselves while CNN’s Jake Tapper nodded along without questioning it.

When asked about the “big beautiful bill” Republicans are trying to pass which will explode the debt, and the fact that Trump’s tax cuts exploded the debt during his last term, Bessent blamed COVID and got very little pushback from Tapper who just moved onto the next topic:

TAPPER: So let’s just talk about Moody’s downgrading America’s AAA credit, citing out-of-control debt, citing growing interest payments on that debt. How concerned are you that this is going to drive interest rates in the U.S. even higher and maybe even drive investment in the U.S. away?

BESSENT: Well, Jake, first of all, that the history of rating agencies by the time, they get to a downgrade everything’s already in the market. Larry Summers and I don’t agree on everything, but, in 2011, the last time or two times ago when he had a downgrade, he pooh-poohed it.

What I think is important is that President Trump has just come back from this historic Mideast trip, and there’s trillions of dollars coming into the U.S. So we are seeing competence from investors, so I don’t put much credence in the Moody’s…

TAPPER: The downgrade comes as Republicans are trying to pass the big, beautiful bill, as the president calls it. It’s a massive bill that has tax cuts, spending cuts.

The nonpartisan Committee for a Responsible Federal Budget says that this bill, if it passes in its current form, will add between $3.3 trillion and $5.2 trillion to the national debt over the next decade. Now, the debt is a concern of yours. You talked about our debt being on an unsustainable path earlier this month. Won’t this bill just make it worse?

BESSENT: There are several components there. So, if we unpack it, there is the growth, the potential growth of the debt. But what’s more important is that we grow the economy faster.

So what we have seen under the past four years and what we inherited — I inherited 6.7 percent deficit to GDP, which was the highest deficit when we were not at war, not in a recession. So we have been trying to bring down the spending and we are going to grow the revenue side.

And so we are going to grow the GDP faster than the debt grows, and that will stabilize the debt-to-GDP, which even Secretary Yellen and I agree is the most important number.

TAPPER: So when in the first Trump administration — you were not a part of it, but obviously President Trump was — there were tax cuts passed, and the Committee for a Responsible Federal Budget says that those tax cuts added $2.5 trillion to the national debt and did not — I mean, there’s always a hope that it will bring about so much revenue growth that it will pay for itself, but that didn’t happen.

BESSENT: Well, we also had something called COVID.

And so there was a Rescue Plan. The…

TAPPER: This is separate from that, though. I’m aware of the COVID trillions.

BESSENT: Yes, but the CBO scoring was about a trillion-and-a-half off.

And, again, what matters is the growth. And during President Trump’s first term, up until March of 2020, we had very high non-inflationary growth. And that’s what I think we can have again this time.

Republicans know full well their bill will explode national debt, which is why Trump was pushing for them to eliminate the debt ceiling. The truth of the matter is, they don’t care one iota about the deficit until a Democrat is back in charge and they can use it as an excuse to slash our social safety nets.