Boeing helped win the space race in 1969. Today, it may lack “a sufficient number of trained and experienced aerospace workers” to repeat the feat.

Uh-oh. It looks like NASA’s Office of Inspector General is mad at Boeing (BA 0.86%) again. And this time it could be serious.

Maybe serious enough to finally get rid of NASA’s white elephant Space Launch System, and replace it with cheaper rockets from SpaceX and Blue Origin.

A litany of complaints

Over the years, the National Aeronautics and Space Administration Office of Inspector General (OIG) has raised numerous complaints about the Space Launch System project, a project led by Boeing, but involving Lockheed Martin (LMT 0.22%), Northrop Grumman (NOC 0.74%), L3Harris (LHX 1.28%) — really, pretty much everybody who is anybody in America’s space industry.

In 2022, for example, it was OIG that broke the news to taxpayers that “the current production and operations cost of a single SLS/Orion system [will be] $4.1 billion per launch for Artemis I through IV.” (Artemis is NASA’s name for the multibillion-dollar effort to return astronauts to the moon.) The cost of SLS alone is estimated at $2 billion, or roughly 4 times the estimated cost back when Artemis was first proposed.

In 2023, OIG tallied up all the costs involved in Artemis to date, and projected the total price tag will hit $93 billion sometime next year. Even if Washington, D.C., where folks are used to big numbers, OIG called that cost “enormous.”

And now, OIG is back with more bad news.

What OIG says about SLS

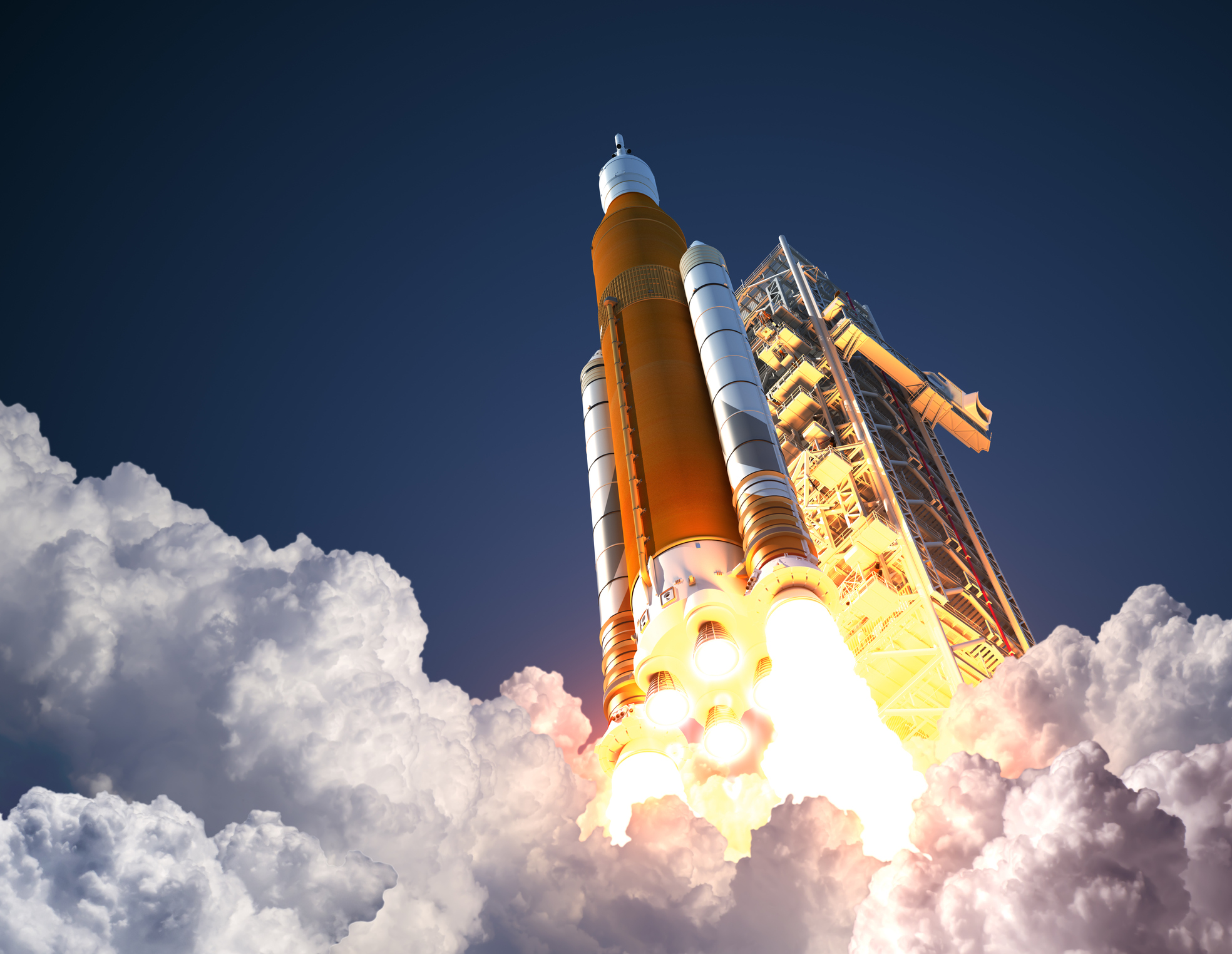

OIG’s report focuses on SLS Block 1B, an upgraded version of the original SLS rocket that flew to the moon and back (sans astronauts) in 2022. Upgraded for 40% better payload capacity, Block 1B is designed to carry both an Orion spacecraft (built by Lockheed) and also an “I-HAB” (provided by the European Space Agency) Lunar Gateway space station habitat module, to the moon for Artemis.

As OIG explains, Boeing is responsible for developing a new Exploration Upper Stage (EUS) for SLS Block 1B, powered by four L3Harris RL10 engines (instead of just one engine in Block 1). Problem is, NASA budgeted less than $1 billion to develop EUS initially, but OIG now says it’ll cost $2.8 billion.

Plus other increases, Block 1B will probably end up costing $5.7 billion just to develop (meaning building and launching each Block 1B rocket will cost more). On top of the $24 billion already spent to develop Block 1, this lifts total SLS development costs (again, development, not including production and launch) to nearly $30 billion.

It almost goes without saying that, in addition to being over budget, Boeing is also behind schedule in developing Block 1B. Initially planned to be ready in early 2021, it’s now looking more likely to finished in early 2027.

While this would be (barely) in time for the planned 2028 launch date for Artemis IV (NASA’s second planned landing of astronauts on the moon this century), OIG warns there’s a real risk that Boeing’s poor quality control could cause NASA to miss that date.

What’s wrong with Boeing

OIG makes no bones about Boeing being to blame for these delays and cost overruns. “Boeing’s quality management system … does not adhere to … NASA requirements,” complains OIG. “From September 2021 to September 2023,” the Defense Contract Management Agency notified Boeing of no fewer than 71 separate “corrective actions” needed on its work.

Not only does OIG call this “a high number” and indicative of “a recurring and degraded state of product quality control.” When notified of deficiencies, OIG says Boeing’s been “inadequate” and “ineffective” at fixing the issues identified, and even “nonresponsive in taking corrective actions when the same quality control issues reoccur.”

And it gets worse. OIG has traced the problem to its source: “the lack of a sufficient number of trained and experienced aerospace workers at Boeing.”

What this means for investors

That a company of Boeing’s reputation — Boeing helped make the Apollo moon landings in the 1960s and 1970s a success, and was prime contractor on the International Space Station — has deteriorated to the point where it now lacks the expertise to build a decent space rocket is alarming. Unfortunately, it’s backed up by the facts — most notably, the highly publicized problems with Boeing’s Starliner spacecraft these past few weeks.

Potentially worse for investors, all of these revelations are coming just months ahead of an expected change of administration in Washington. Might the next president decide to curtail use of Boeing SLS rockets in favor of SpaceX’s Starship or Blue Origin’s New Glenn, for example? I don’t think we can rule that out. Might the new administration decide that cost overruns on SLS are so out of control that Artemis should happen without any use of SLS? That, too, is a risk.

Indeed, given the central role SLS plays in Project Artemis as a whole, Boeing’s issues with SLS could potentially lead a new administration to cancel plans to return to the moon entirely — much like the Obama administration canceled the Bush-era Constellation moon program in 2010. And that could have ramifications all across the space industry, from Boeing to Lockheed to Northrop to L3Harris, and beyond.

Admittedly, this a doomsday scenario. But it’s also a realistic worst-case outcome of Boeing’s difficulties with SLS. Space investors need to be aware of the risk.