The secondary market for private company stock has emerged as an economically vital ecosystem for millions of U.S. private company employees and institutional investors. A steady and dramatic trend of the past 20 years is that companies are waiting longer to IPO, from roughly five years in 2000 to nearly 12 years today. As a result, the size of the private market has grown to a staggering size, rivaling that of the U.S. municipal bond market. With over 1,400 unicorns globally valued at approximately $4 trillion according to the Crunchbase Unicorn Board, the private market now rivals the public market in significance to the economy, yet it lacks the basic infrastructure and fundamental plumbing to allow it to function efficiently.

Nasdaq Private Market: bridging the gap in the private market

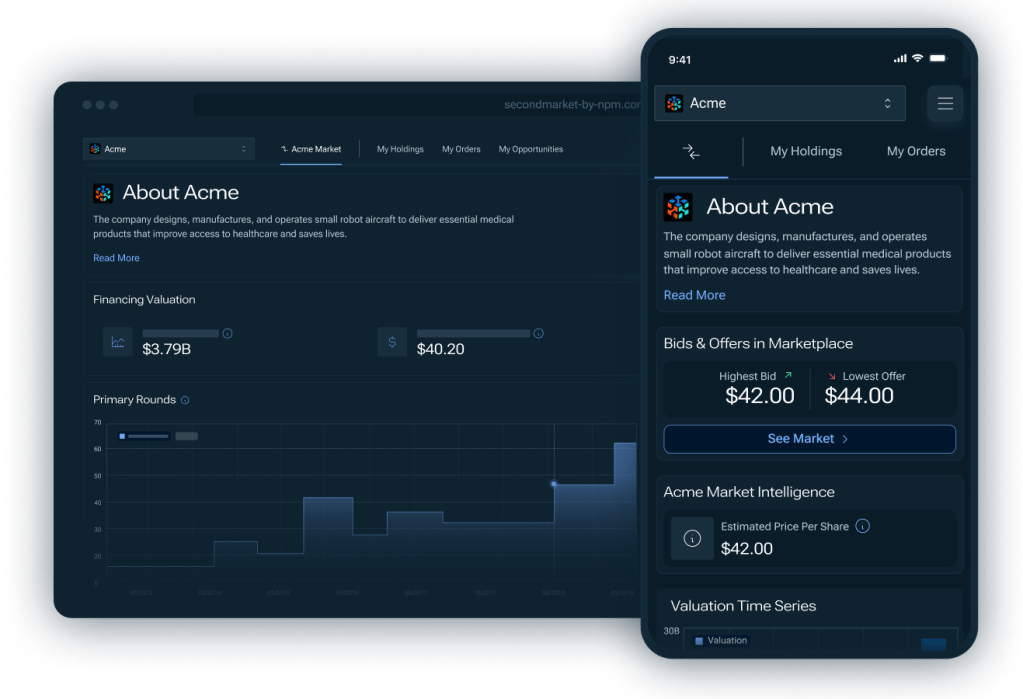

As the secondary market for private company stock grows, trusted platforms like NPM SecondMarketTM can assist counterparties across the ecosystem. As a comprehensive solution for private stock trading, SecondMarket aims to provide accurate data, streamlined trade lifecycle management, transparency, and reliability for market participants. With a decade supporting clients in the private markets, the company has executed over $50 billion in transaction volume since inception, year to date it has seen more than $4 billion in secondary trading activity. This platform not only brings much-needed order and confidence to a rapidly expanding market but also empowers employees and investors with the tools and information necessary to make informed trading decisions.

Data and guidance

The importance of accurate trade and private company data cannot be overstated in a market where valuations can sometimes be opaque and inconsistent. NPM offers detailed information on share value, helping employees and investors build confidence and achieve fair market execution for their shares. NPM helps clients navigate secondary trading and execute private company stock transactions. The platform’s intuitive technology and experienced team make the onboarding, execution, and settlement process seamless.

Trade lifecycle management: transfer and settlement of shares

In the public markets, trades now settle quickly and investors typically aren’t concerned about settlement risk. In the private markets, the opposite is true. Trades often take months to settle. Friction is typically normal throughout the execution of trades. Employees, investors, and designated private company equity administration personnel can be left to navigate on their own how to transfer shares and access funds. NPM offers a settlement service to private companies and investors to ensure a more efficient process that can cut settlement times down to a week. By managing the entire process from end-to-end, NPM reduces risk and uncertainties throughout the trade lifecycle.

Transparency + fees

Transparency is crucial for private market participants. Unlike the public markets, the private market lacks a consolidated tape, making it difficult to determine real-time private stock prices. NPM addresses this by aiding sellers in researching recent funding rounds and secondary trade history to ensure fair pricing when buyers and sellers want to transact. Some liquidity providers in the private market often take advantage of the lack of information about share value and fees. They may charge exorbitant fees for buyers and sellers to transact on their platforms, which can be as high as 8%. Alternatively, NPM operates a trusted marketplace with low fees and high integrity, helping sellers understand the fair market value of their shares and offering a flat, 1% commission fee on all trades.

Reliable buyer network

The extensive NPM network of institutional investors includes a roster of some of the largest and most sophisticated buyers of private shares in the world. This is augmented by NPM’s ownership structure, which includes a number of the largest and most well-respected banks and asset managers in the world such as Allen & Company, Bank of America, BNP Paribas, Citi, DRW Venture Capital, Goldman Sachs, HiJoJo Partners, Morgan Stanley, UBS, and Wells Fargo. This powerful global network of investors offers employees one of the best possible opportunities to market their shares and achieve fair market value for them, which can deliver a more efficient trading experience for all trade counterparties.

Maintaining company oversight

Unlike the public markets, private company share transfers require company approval for all trades. NPM allows companies to retain complete control and oversight over all transactions executed on the platform. In parallel, NPM’s advanced trading technology supports employees in navigating the company approval processes, automating each step and thoroughly verifying completion of each required authorization. Deploying advanced secondary trading technology such as SecondMarket helps users of the NPM platform sell shares seamlessly.

Supporting a $4 trillion market

The rise of the secondary market for private company stock signals a pivotal shift in the financial landscape. As the private market swells in size, millions of private company employees rely on these markets to generate liquidity that funds important life events such as buying houses, paying tuitions, and investing in new businesses. Given their rapid growth, the private markets may be the future of the capital markets. Platforms like NPM are therefore crucial in providing the necessary infrastructure and transparency to power this rapid growth and increasingly critical need.

VentureBeat newsroom and editorial staff were not involved in the creation of this content.