Amazon Web Services is the king of the cloud, but Microsoft Azure is growing significantly faster.

Most artificial intelligence (AI) development happens in the cloud, with the help of tech giants like Microsoft (MSFT -3.27%) and Amazon (AMZN -4.10%). Microsoft Azure and Amazon Web Services (AWS) operate centralized data centers filled with chips from leading suppliers like Nvidia, and they rent the computing power to developers who use it to create AI applications.

Plus, developers can access ready-made large language models on Azure and AWS, including those from leading AI start-ups like OpenAI and Anthropic, to accelerate their progress.

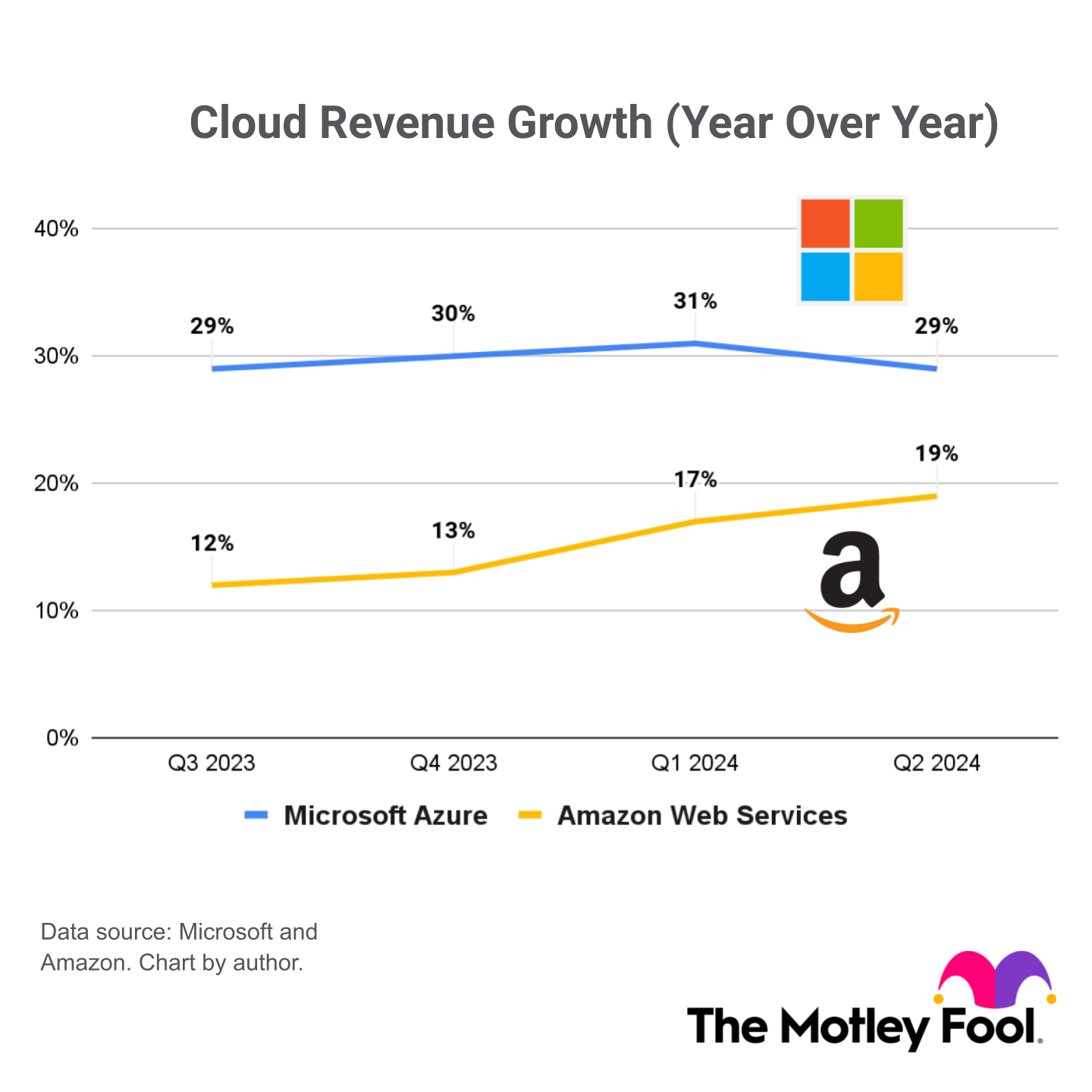

AWS is the largest provider of cloud services and infrastructure in the world, followed by Azure in second place. However, Azure grew its revenue by 29% in the most recent quarter (ended June 30), with eight percentage points attributed to AI alone. AWS only grew its revenue by 19% during the same period, and the gap, while narrowing, has been a consistent theme:

Microsoft doesn’t disclose how much revenue Azure brings in, but it recently said the cloud platform was responsible for about half of its “Microsoft Cloud” revenue. During the latest quarter, Microsoft Cloud generated $36.8 billion in revenue, implying Azure probably generated around $18.4 billion.

That means it has a way to go to catch AWS, which generated $26.3 billion in revenue during its latest quarter. But with the current 10% growth differential, Azure could overtake AWS within five years — and possibly even sooner if the growth gap widens to where it was earlier this year.

Microsoft became an early mover in the AI race when it agreed to invest $10 billion in OpenAI in 2023. The start-up’s latest GPT-4o models are among the best in the industry, and they are now available on Azure. That could be a key consideration for developers when selecting a cloud provider.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.