Rigetti Computing is in a high-stakes race to capture the quantum computing market.

Quantum computing could solve humankind’s most challenging problems and someday create countless new technologies and markets. It uses physics to take computing technology to new heights — levels that, frankly, are difficult to comprehend.

For example, late last year, Google (Alphabet) announced a quantum computing chip capable of five-minute calculations that would take today’s top computers 10 septillion years. That’s 10,000,000,000,000,000,000,000,000 years — longer than the universe is old!

Investors have flocked to early-stage quantum computing companies like Rigetti Computing (RGTI 0.36%), hoping for life-changing returns as these companies monetize their technology.

But are investors too early? Here’s a look at whether you should buy Rigetti Computing stock.

Cutting through the quantum hype

In its simplest form, all digital information in today’s technology breaks down into basic units called classical bits. These bits act like a light switch. They’re either a one or a zero, like being in the off or on position.

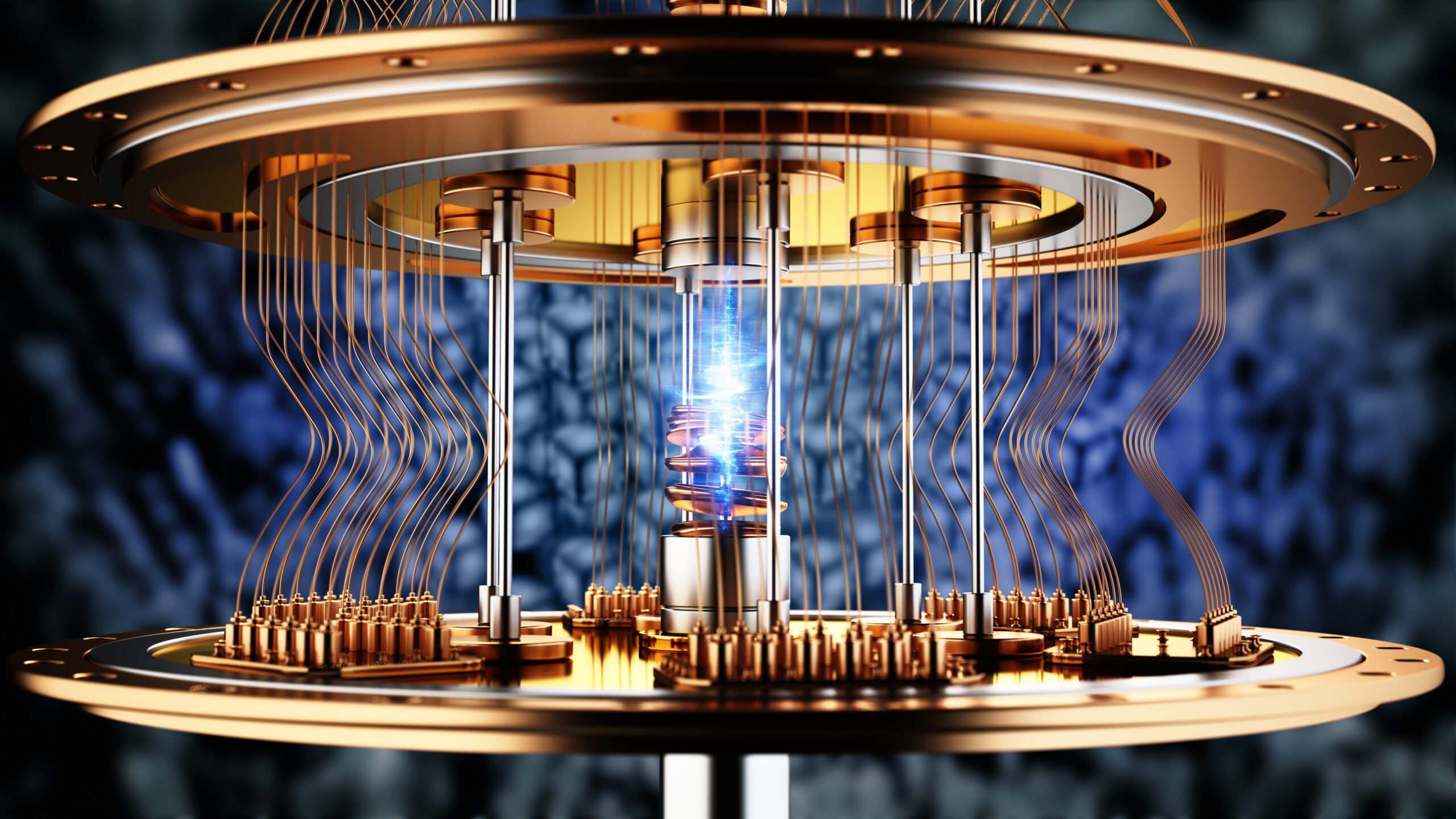

In quantum computing, these basic information units are called qubits. They can exist as a one, zero, or a combination of both. Qubits represent far more information than classical bits, allowing for more complex calculations and dramatically better performance.

However, maintaining qubits isn’t easy. It requires highly controlled environments, and qubits are prone to computational errors. Companies developing quantum computers aren’t just trying to achieve more qubits; they must also minimize mistakes. The reality is that quantum computing isn’t nearly refined enough for practical use.

But don’t ask me. Ask the people at the forefront of quantum computing.

In January 2025, Nvidia CEO Jensen Huang declared in an analyst question-and-answer session that useful quantum computers were between 15 and 30 years away. Nvidia recently held a quantum computing event where Rigetti Computing’s CEO, Subodh Kulkarni, admitted that its quantum computers weren’t good enough for practical use. Earlier this year, Alphabet CEO Sundar Pichai predicted practical quantum computers were five to 10 years away.

It is anyone’s guess when quantum computers will be ready for real-world applications. Still, the consensus among those involved seems that investors probably shouldn’t expect much for a while. Rigetti Computing’s investor presentation estimates the market opportunity for quantum computing providers won’t surpass $1 billion to $2 billion until after 2030.

Investors face risks in waiting

What does Rigetti Computing offer investors who buy shares in 2025? Unfortunately, there isn’t much to go on. The stock has a $2.6 billion market cap at its current share price.

Rigetti Computing has competitors, including fellow youngster IonQ and entrenched technology leaders like IBM, Amazon, Alphabet, and Microsoft.

Suppose quantum computing is worth $2 billion by 2030, and Rigetti captures a tenth of the market for $200 million in annual revenue. That means the stock trades at a price-to-sales ratio of 13 using hypothetical revenue five years away! Plus, investors don’t know whether Rigetti will be profitable by then.

To make things worse, the company continues to issue stock, causing share dilution:

RGTI Average Diluted Shares Outstanding (Quarterly) data by YCharts

The share count has doubled since Rigetti Computing went public, meaning it needs twice as much revenue to maintain the same stock valuation. How much more will the share count rise between now and 2030? There’s a scenario where the business performs better than hoped, but the investment returns stink because management diluted shareholders.

Is the stock a buy?

Rigetti Computing has a wide range of potential business outcomes between now and 2030, and the stock arguably has an even wider disparity because of factors like dilution and valuation that will impact the stock’s returns.

I would not buy the stock here. It seems more likely that the cloud companies involved with quantum computing, namely Amazon, Microsoft, and Google, will capture the early quantum computing market. Google just agreed to buy a cloud security company for $32 billion. If a small company, like Rigetti Computing, worth under $3 billion, were genuinely leading the field, wouldn’t one of these technology giants acquire it?

This is rhetorical, of course, but it’s worth thinking about. The bottom line is that Rigetti Computing stock is like a lottery ticket, except you might wait half a decade to see if you were right. There are better ways to invest your money, so consider looking elsewhere.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, International Business Machines, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.