One single Space Force contract could expand the small company’s revenue by nearly 50% annually.

From April 2 to April 8, the S&P 500 index fell by more than 12% in response to President Donald Trump’s imposition of steep “reciprocal tariffs” on imports from nearly every country around the world. The market surged back by 9.5% after Trump temporarily paused some (but not all) of his new tariffs on Wednesday — but then swung around and gave back half of those gains on Thursday as investors further digested where the looming trade war stood.

“Roller coaster” doesn’t begin to describe the ride we investors find ourselves on right now. “Tower of Terror” would be more accurate.

And yet, if you’ll forgive me for switching metaphors, it’s during times like these that investors must take care not to miss the forest for the trees. And the forest surrounding space company Rocket Lab (RKLB 0.05%) is looking very, very green right now.

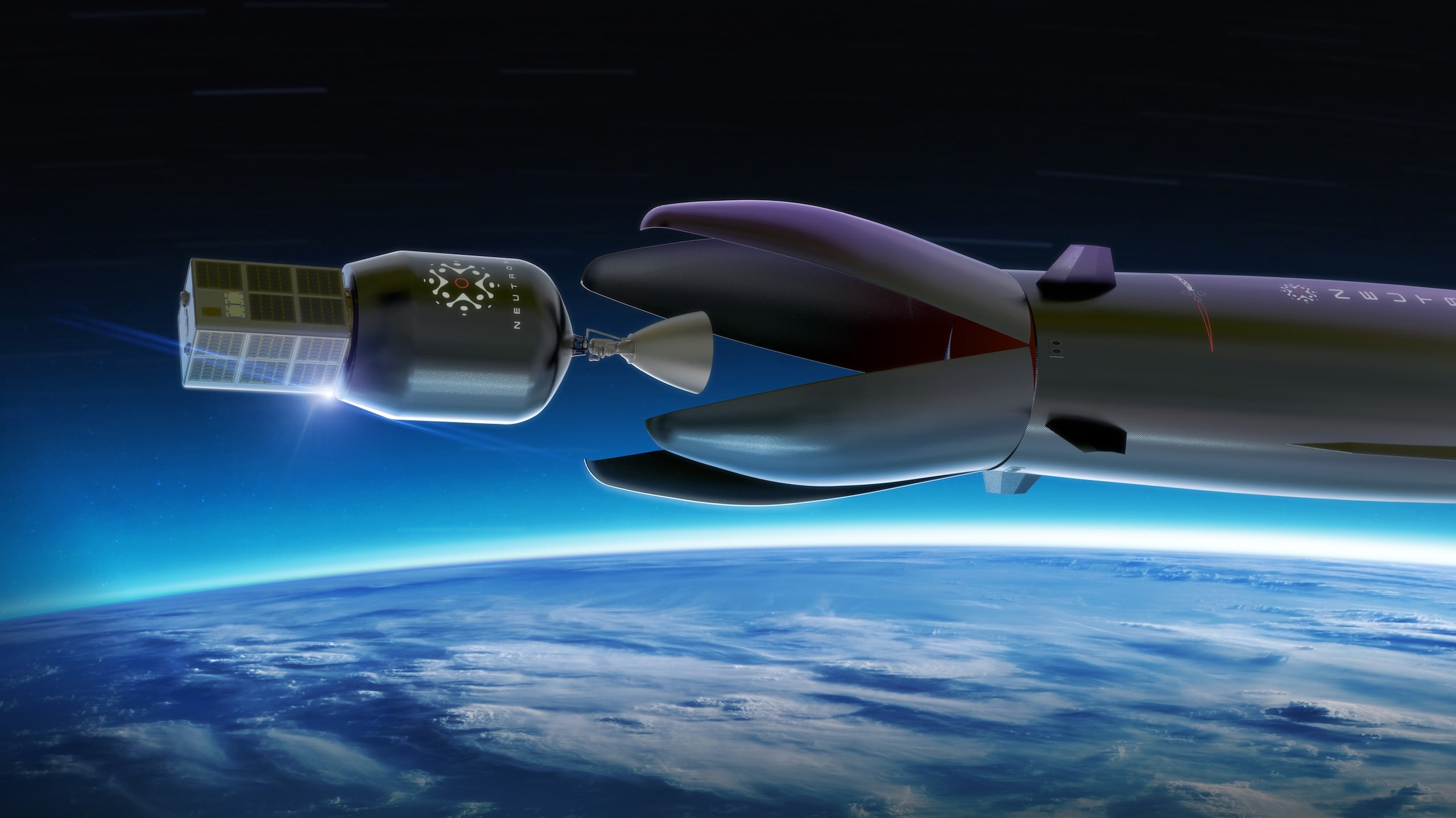

Rocket Lab’s big Neutron news

Late last month, before tariff news started taking over all the headlines, Rocket Lab announced that the U.S. Space Force had included it in Phase 3, Lane 1 of the National Security Space Launch program, (NSSL3.1).

What is NSSL3.1? Basically, it’s an umbrella contract under which the government gathers all of the companies that it believes will be capable of launching the kinds of satellites and spacecraft it will want launched over the next five years. The government has set a maximum value for all contracts to be awarded under that umbrella, and all the companies sitting in its shade can bid on the various specific launches that need to be done. (In the industry, this is known as an indefinite delivery, indefinite quantity (IDIQ) award.)

In the specific case of NSSL3.1, the IDIQ is valued at $5.6 billion, meaning that theoretically, Rocket Lab could win up to $5.6 billion worth of contracts from Space Force over a period running from June 2024 through June 2029.

How much money will Rocket Lab get?

In reality, the contracts awarded and money earned under NSSL3.1 will almost certainly be spread across all five companies that have been put under the umbrella — of which Rocket Lab is only one. So an extremely rough guess might be that Rocket Lab will end up getting 20% or so of the money on offer — $1.1 billion. Spread over the five years of NSSL3.1, that would amount to additional annual revenues of $220 million for the company.

Granted, “$220 million” may not sound as impressive as “$5.6 billion.” It’s still an amount equal to just over half of all the revenue Rocket Lab raked in last year.

Who else is playing?

Other competitors for NSSL3.1 include Blue Origin, SpaceX, the United Launch Alliance (a Boeing (BA 0.89%) and Lockheed Martin (LMT 2.46%) joint venture), and also privately held space company Stoke Space.

So while Rocket Lab, Boeing, and Lockheed Martin are only a few of the space companies under this umbrella contract, they are the only ones that retail investors can easily invest in.

One factor that may work against Rocket Lab in winning specific launches is the fact that, unlike Blue Origin’s New Glenn, SpaceX’s Falcon 9, or United Launch Alliance’s Vulcan, the rocket that Rocket Lab will be offering in its bids on NSSL3.1 contracts, Neutron, has not yet actually flown into orbit. Nor, for that matter, has Stoke’s “Nova” rocket, so Stoke is at a similar (hopefully temporary) disadvantage.

Investors should anticipate that the first task order contracts awarded under NSSL3.1 will probably go to the companies that already have rockets that are certified and flying: Blue Origin, SpaceX, and United Launch Alliance.

Image source: Rocket Lab.

What’s next for Rocket Lab?

Whether Rocket Lab can overcome its disadvantages, and how many launch contracts it will end up winning under NSSL3.1, will depend heavily on how soon it’s able to conduct its inaugural Neutron rocket launch. Plans for a launch by around mid-year were recently upset, but if all goes well, Rocket Lab could still get its first Neutron into orbit in the second half of 2025.

If it succeeds, the company stands a good chance of winning a substantial portion of the NSSL3.1 funds on offer over the next few years. It also, in the opinion of Wall Street analysts, will stand a good chance of turning free-cash-flow positive as early as next year.

Rich Smith has positions in Rocket Lab USA. The Motley Fool recommends Lockheed Martin and Rocket Lab USA. The Motley Fool has a disclosure policy.