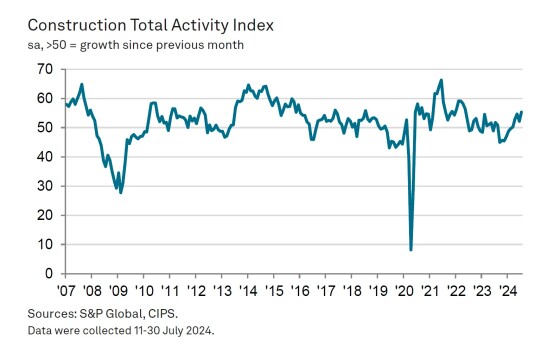

July 2024 saw a solid increase in both construction activity and new orders, according to the monthly survey of the industry’s buyers. Firms ramped up purchasing activity and raised staffing levels for the third month running.

The headline S&P Global UK Construction Purchasing Managers’ Index (PMI) – a seasonally adjusted index tracking changes in total industry activity – rose sharply to 55.3 in July from 52.2 in June. The reading signalled a marked monthly expansion in total activity in the construction sector, extending the current sequence of growth to five months.

Moreover, with a new governemnt elected on 4th July, the rate of expansion during the month was the fastest since May 2022.

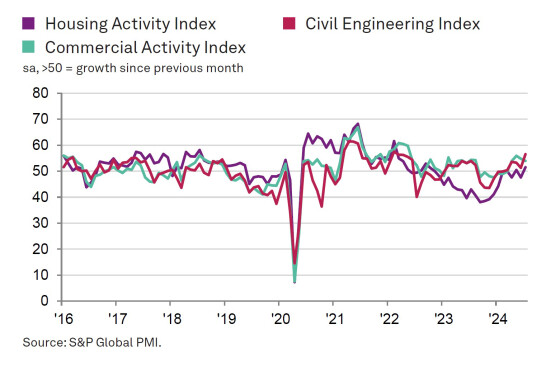

All three categories of construction saw activity increase in July as work on housing projects returned to growth. Commercial activity increased solidly, but the fastest expansion was seen in civil engineering activity, where the rate of growth quickened to the sharpest in almost two-and-a-half years.

According to respondents, success in securing new orders was the main factor leading to a rise in construction activity at the start of the third quarter. New business expanded for the sixth month running, and at a pace that was the strongest since April 2022. Alongside a general improvement in market demand, there were also reports that customer confidence had strengthened, making them more willing to release previously paused projects.

Rising workloads led construction firms to expand both their purchasing activity and employment more quickly in July.

Staffing levels were up for the third consecutive month, and at a solid pace that was the fastest for a year.

Increased demand put some pressure on suppliers in July, resulting in broadly unchanged lead times during the month. This ended a 16-month sequence of improving vendor performance. Panellists also reported issues with manufacturing and transportation. On the other hand, some respondents indicated that suppliers had sufficient stocks to keep on top of orders.

The rate of input cost inflation showed signs of rising again as suppliers put up prices in line with stronger demand. The increase in input costs was the joint-fastest in 14 months, equal with that seen in January 2024.

.gif)

Construction firms remained strongly optimistic that activity will expand over the coming year, the survey authors said, although sentiment dipped to a three-month low. Improving client confidence is predicted to help lead to growth of new orders and subsequently activity. Close to 53% of respondents predicted a rise in activity over the next 12 months.

Andrew Harker, economics director at S&P Global Market Intelligence, which compiles the monthly survey, said: “The election-related slowdown in growth seen in June proved to be temporary, with the pace of expansion roaring ahead in July. Firms saw the strongest increases in new orders and activity since 2022 as paused projects were released amid reports of improved customer confidence.

“The strength of demand moved the sector closer to capacity, bringing a recent period of improving supplier performance to an end. There were also signs of inflationary pressures picking up, something that will need to be watched closely if demand strength continues in the months ahead.”

Brendan Sharkey, construction partner at accountancy network MHA, said: “As anticipated, construction PMI has remained over 50 for the fifth month in a row with a strong increase above expectation to a two year high, highlighting that the sector has moved from green shoots to a real recovery for the sector. The recent cut in interest rates has also buoyed the industry, and businesses will now feel that the cost of borrowing cycle is on a downward trajectory, hopefully encouraging them to invest.

“The rhetoric from the new UK government so far has been good and will please the construction industry. This, along with the easing of rates, improving supply chains, competitive pricing , and fewer labour shortages, suggests that we are now firmly turning a corner.

“However, the recent announcements on the cancellation of major infrastructure contracts, such as the project in Stonehenge, has caused some concern among our clients. Given the government has highlighted that there is a significant black hole in public finances and further cuts in government spending will need to be made has led to nervousness that the recent news is only the tip of the iceberg and more will be announced in due course.

“We are hearing mostly positive signals from the new government, but the devil will, as always, be in the detail to provide the market with some concrete foundations for optimism. For many reasons the budget in October should clarify much of this and it cannot come quickly enough.”