The beaten-down silicon carbide stock rallied as a sell-side analyst became upbeat on customer wins.

Shares of beleaguered chipmaker Wolfspeed (WOLF 20.84%) rocketed 20% higher on Friday as of 3:54 p.m. EDT.

Wolfspeed, which had seen its stock crash 93% off its 2021 highs, was perhaps due for a bounce on any good news. And some good news came today on the back of positive sell-side analyst commentary and hopes for new customer wins.

Roth/MKM thinks Wolfspeed is landing new customers

In a note today, sell-side analysts from Wolf/MKM reiterated their buy rating on Wolfspeed shares, maintaining a $25 price target, significantly higher than the $9.50 stock price at yesterday’s close.

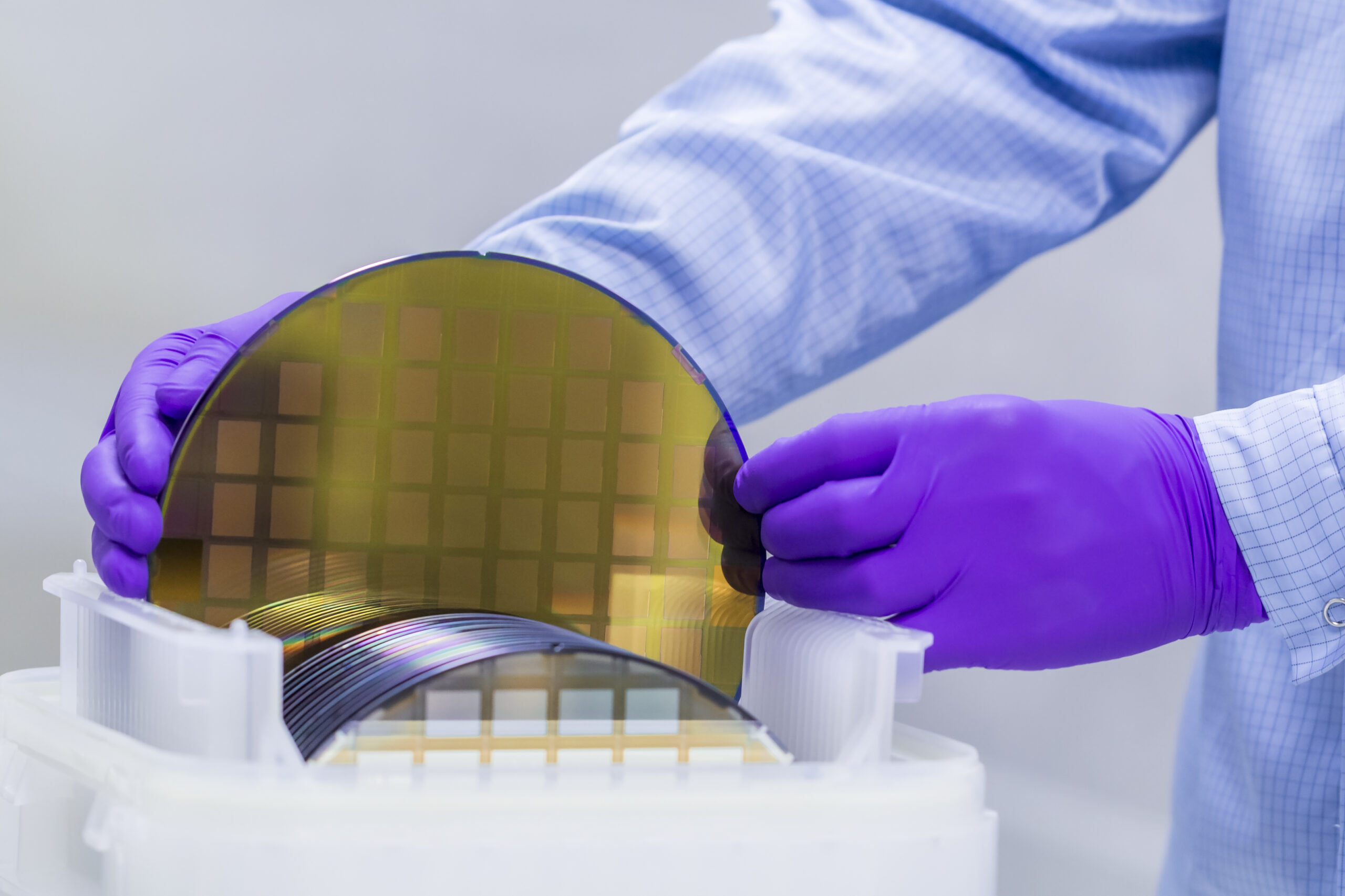

The analysts are optimistic Wolfspeed will attract top silicon carbide (SiC) customers as its 200mm wafer plant gets up and running; chips produced on the larger 200mm wafer are lower-cost than those produced on 150mm wafers where most SiC chips are produced today. One of the Roth/MKM analysts noted that certain negotiations with SiC customers for electric vehicles (EVs) may be nearing their conclusion, which would be a big lift and a validation of its technology.

Wolfspeed has been spending heavily on getting new silicon carbide plants up and running, costing it billions of dollars. However, there has been little revenue to show for it thus far, with last quarter’s earnings report showing underwhelming revenue and profits. The larger EV space has also been in a downturn, potentially delaying contracts.

Roth/MKM also anticipates Wolfspeed will receive some CHIPS Act funding before the election as well, which should help stem the cash burn that has caused investors to flee as the company spends heavily ahead of theoretical revenues and profits.

Be careful chasing Wolfspeed’s rally

So, is today’s gain worth chasing? It’s a risky move. The outsized gain could be attributed to lots of short-covering, as Wolfspeed’s short interest was a whopping 31% of shares outstanding as of Sept. 30. With a short interest that high, any positive news can cause a huge amount of buying as shorts cover. So, I wouldn’t assume today’s move higher will last.

Investors may want to wait for more tangible signs of revenue growth and margin expansion from Wolfspeed’s new facilities before delving into this tricky turnaround story.

Billy Duberstein and/or his clients have no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Wolfspeed. The Motley Fool has a disclosure policy.