Semiconductor and AI leader Nvidia (NVDA) reports earnings next Wednesday, August 28 after the market close and investors are waiting with bated breath. Nvidia’s remarkable performance over the past two years is almost unfathomable, yet the company’s expansion appears it should continue at this same rapid pace for years to come.

Here, we will cover the path Nvidia has taken to get to its current position, what to expect from next week’s earnings report and whether it’s possible for Nvidia to reach a $10 Trillion market capitalization.

The results Nvidia has provided its shareholders with over the last 25 years is truly hard to understate. Over that period, the stock has compounded at an annual rate of 35.4%, yielding a dizzying 217,000% return. Even more recently, over just the last five years, NVDA stock has compounded at an annual rate of 98.5%, 30xing investor money over that time.

Image Source: Zacks Investment Research

How Did Nvidia Stock Get Here?

At the depths of the 2022 bear market, Nvidia had a market cap of $250 billion; today, it stands at a staggering $3 trillion. The meteoric rise is a direct result of Nvidia’s strategic focus on AI infrastructure through its data center products. Since the pivot, annual sales have nearly quadrupled to $80 billion, and are expected to double again by 2026. Even more impressive is that Nvidia boasts 53% net margins on that revenue.

Fueled by surging demand for AI-driven solutions, Nvidia positioned itself at the heart of the AI revolution. Nvidia’s focus on strategic partnerships with major cloud providers, its continued innovation in AI software (like the CUDA platform), and its ability to foresee the massive potential of generative AI were key to the stock’s unprecedented rally.

Partnering with fellow tech giants such as Amazon (AMZN), Microsoft (MSFT) and Alphabet (GOOGL) has been the primary driver of its growth. Because Amazon, Microsoft and Alphabet run massive cloud computing operations, and much AI development will occur in the cloud they have plowed tens of billion into Capex spending. While this is hugely beneficial to Nvidia, it is also good for all three major cloud providers. It’s a symbiotic relationship as Amazon, Alphabet and Microsoft add more power users to their platforms and Nvidia sells them the hardware.

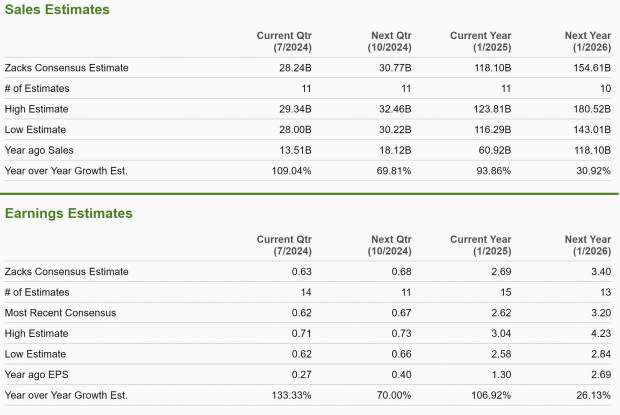

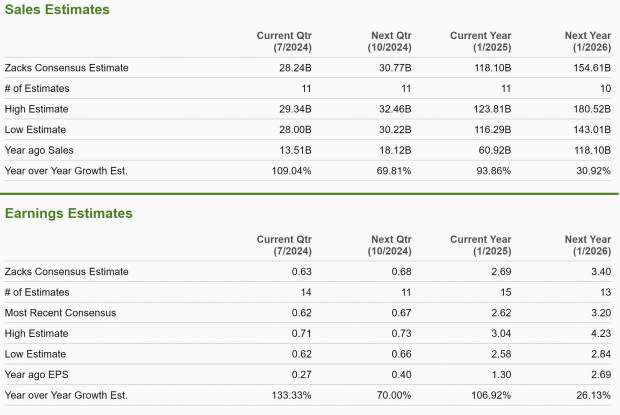

Nvidia Earnings Estimates

If we look at the current quarter earnings forecasts, we can put into perspective the incredible pace that Nvidia continues to grow both the top and bottom line. Sales for the quarter are expected to grow 110% year over year (YoY) to $28.2 billion, while earnings are projected to climb 133% YoY to $0.63 per share. Looking further out to the expectations are equally impressive.

Although Nvidia had sat atop the Zacks Rank for nearly two years, as analysts were continuously upgrading earnings estimates, today it has a Zacks Rank #3 (Hold) rating, which most definitely isn’t a negative thing. There is nothing bearish about a rank #3, just simply that earnings estimates haven’t been upgraded recently.

Image Source: Zacks Investment Research

Can Nvidia Reach $10 trillion?

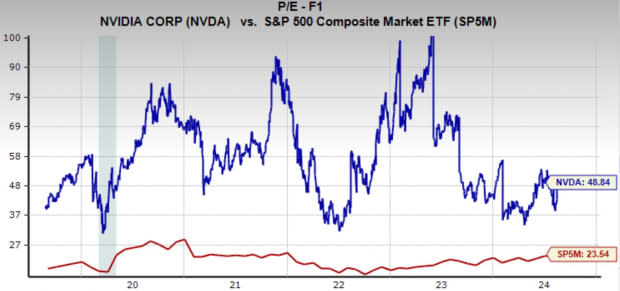

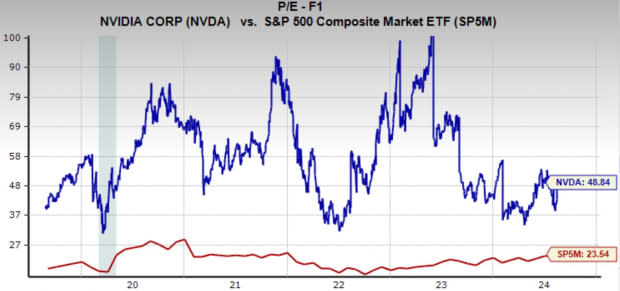

It isn’t just possible, it’s likely Nvidia will reach a market cap of $10 trillion within the next five years based on current forecasts. Today, Nvidia has a one year forward earnings multiple of 48.9x, which is well below its five-year median of 55x. Incredibly, Nvidia has grown so fast that even though the stock price is up 20x in the last five years, it is still close to its cheapest relative valuation because of the incredible profit growth.

To get to the conclusion that Nvidia may be worth $10 trillion is of course quite speculative, however a simple extrapolation shows how it is not an unreasonable expectation. Earnings are forecast to grow 37.6% annually over the next three to five years, and if the stock grows at that pace while maintaining its current earnings multiple, it would be there in under five years.

Image Source: Zacks Investment Research

Should Investors Buy Shares in Nvidia?

For investors seeking exposure to AI and high-growth tech, Nvidia remains among the most compelling options. Despite the incredible run-up in its stock price, the company’s leadership in AI infrastructure, strategic partnerships, and unmatched growth rates suggest that Nvidia could still have significant upside potential.

At its core, Nvidia is positioned to remain a key player in the AI revolution, with its GPUs powering the future of AI-driven industries. The company’s focus on continuous innovation and its partnerships with major cloud providers like Amazon, Microsoft, and Alphabet provide a strong foundation for future growth.

While Nvidia’s valuation is relatively high, it is backed by extraordinary earnings growth that is expected to continue at a rapid pace. The company’s potential to reach a $10 trillion market cap underscores its long-term growth trajectory, making it an attractive investment for those with a higher risk tolerance and a long-term perspective.

In conclusion, Nvidia’s stock may be a buy for investors who believe in the future of AI and are willing to weather short-term market volatility in exchange for long-term gains. With its leadership in the AI space and strong earnings growth projections, Nvidia could continue to reward investors as it moves toward new milestones.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research