The market has been on the fence about coffee chain Dutch Bros (BROS -0.90%) for much of the enterprise’s brief history as a public company. But it’s firmly on the buy side as of its most recent earnings report, and Dutch Bros stock is up about 67% year to date.

Did you miss the boat? I don’t think so. Dutch Bros stock is still 30% off of its all-time highs, and it has incredible opportunity. Here’s why.

A different kind of coffee chain

Dutch Bros is an Oregon-based coffee shop chain that hasn’t been around quite as long as Starbucks, but it still has more than three decades of experience. It’s only recently started a domestic expansion strategy, identifying an opportunity to market its beverages nationally. It’s had several shops along the West Coast for years, but since it’s gone public, it has steadily traveled east across the lower states and was operational in 18 U.S. states as of the 2024 third quarter.

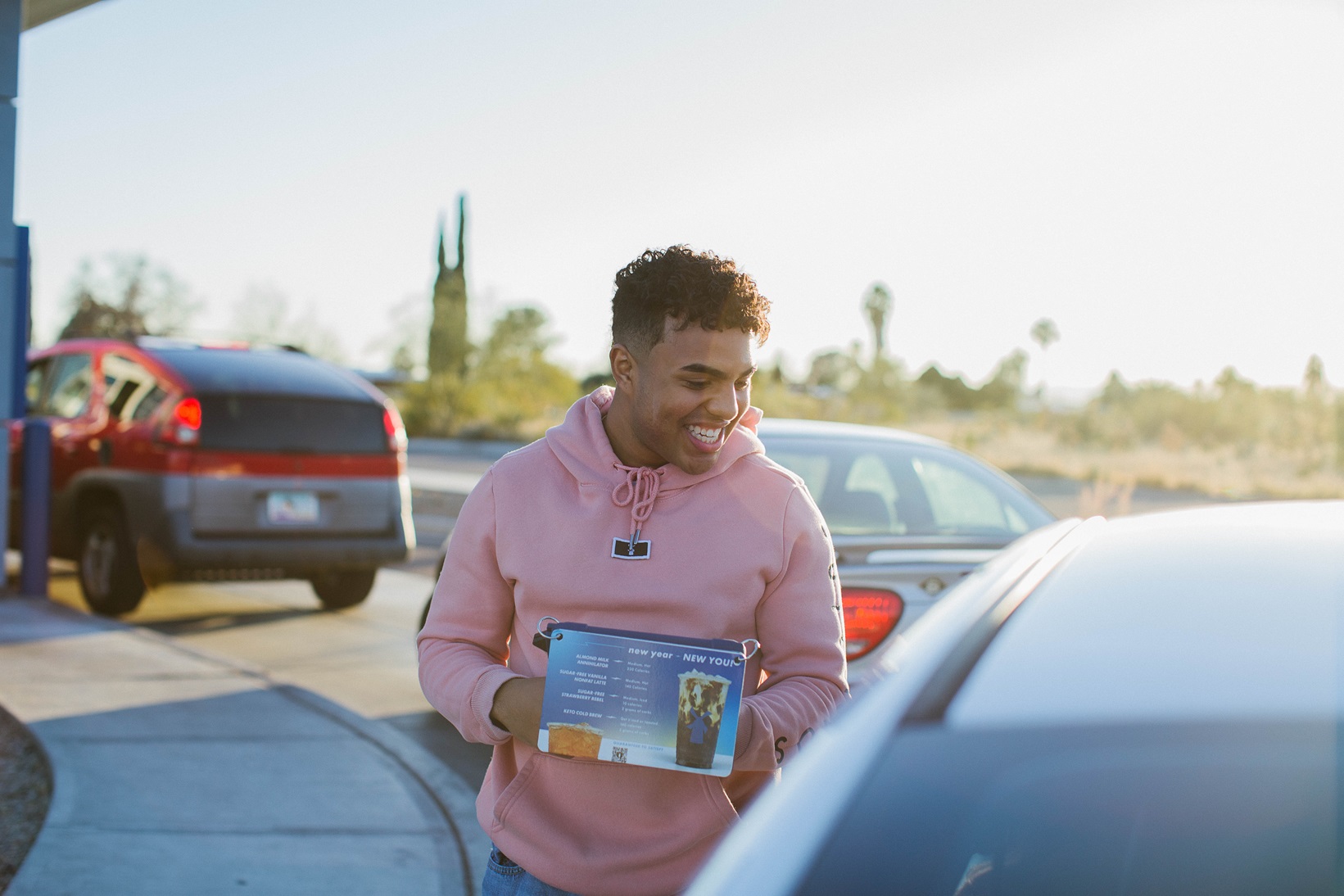

Dutch Bros has a distinctive feel and culture with a focus on speed and customer service. Most of its stores have drive-thrus, and its branded customized beverages are resonating with the coffee-drinking public.

Sales have been brisk. They increased 28% year over year in the third quarter, and scale is leading to profitability. Net income increased from $13.4 million last year to $21.7 million this year in the quarter.

Same-store sales have been less stellar. There are a few reasons for that, which include a smaller base of stores in that category, people holding back because of inflation, and new regional stores that draw from existing stores. Same-store growth of 2.7% year over year in the third quarter still surpassed expectations, and that implies a viable store network that’s achieving brand-building goals.

An effective expansion plan

Dutch Bros’ main growth driver right now is new stores. It opened 38 new stores in the third quarter and plans for 150 for the year. It restructured its real estate strategy recently, and while that’s resulting in fewer store openings than originally thought, it’s a more efficient strategy that has better financial benefits. Dutch Bros is still fairly young, and there are going to be these kinds of learning moments along the way.

The founder-CEO stepped down last year, and new CEO Christine Barone stepped in to lead the company into a new growth chapter. Dutch Bros is refining its image and processes to expand at a steady and deliberate pace, identifying the right regions, formats, and locations to roll out successfully. It just introduced mobile ordering throughout its enterprise, and right now it only accounts for 7% of orders. That should increase and generate higher sales. The company is also piloting walk-up windows to meet demand in innovative ways.

Dutch Bros envisions reaching about 4,000 stores over the next 10 to 15 years, and that’s a huge amount of built-in growth. If you have confidence in the company’s approach, it’s easy to see how it could become a massive presence and its stock could become a multi-bagger. However, it’s going to require patience.

You can still buy in at this price

I’ve been debating about Dutch Bros at its current valuation. Shares recently traded at a forward P/E of 118, which is rich, and a price-to-sales ratio of 4.

Growth stocks do get a premium valuation because there’s a lot that investors expect. The sales-based valuation is much lower than it was two years ago and might be more reliable than the earnings-based ratio. That’s because Dutch Bros hasn’t been profitable for long, and net income is growing quickly. It trades at a PEG ratio of 0.3, which means it could still be undervalued.

At the current price, Wall Street doesn’t see a lot of upside; the average analyst target price is only 3% higher than today. That’s only over the next 12 to 18 months. But you can’t time the market. If you have a long time horizon, you can buy Dutch Bros today and hold it for many years. You might want to use a dollar-cost averaging strategy to lock in some stock today but benefit from a potentially better entry point later.

Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Starbucks. The Motley Fool recommends Dutch Bros. The Motley Fool has a disclosure policy.